IRS Wage Garnishment Table

How much can the IRS garnish?

How much can the IRS Garnish?

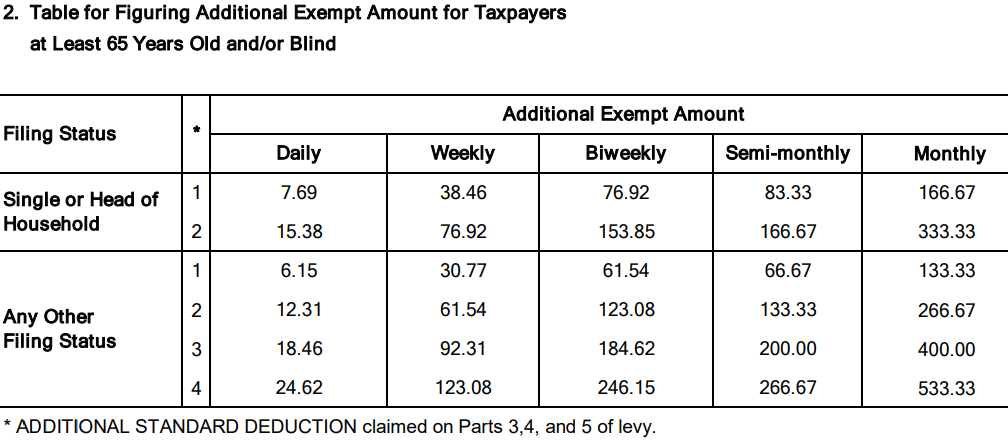

The amount the IRS will garnish from your wages are dependent upon different factors like your marital status and other personal financial obligations. If you’re single, married or have a family to support, your garnished amount will vary.

Why Is It Important To Understand the IRS Wage Garnishment Table?

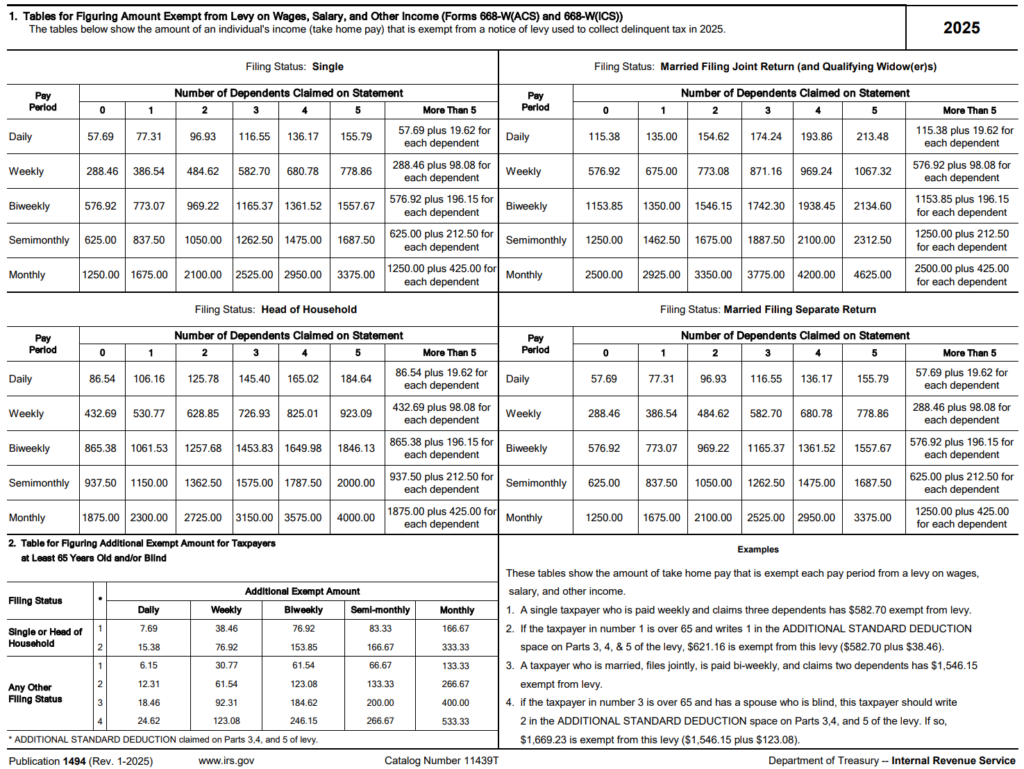

It is highly recommended to understand the IRS wage garnishment to know how much income will be legally withheld to meet your IRS tax debt. The following table below is important as it will provide you with specific situations you may find yourself in for a more accurate financial planning and negotiation approach with the IRS.

What is the IRS Wage Garnishment & How to Stop it?

The IRS wage garnishment is a legal process by the IRS enforcing your employer to withhold a portion of your income to cover the tax debt. The IRS usually applies this as a last resort, if the taxpayer is not voluntarily coming forward to address the debt. That’s why the only way to stop it is by contacting the IRS about the outstanding debt balance and set up an installment agreement, where you will be paying off the debt over time.

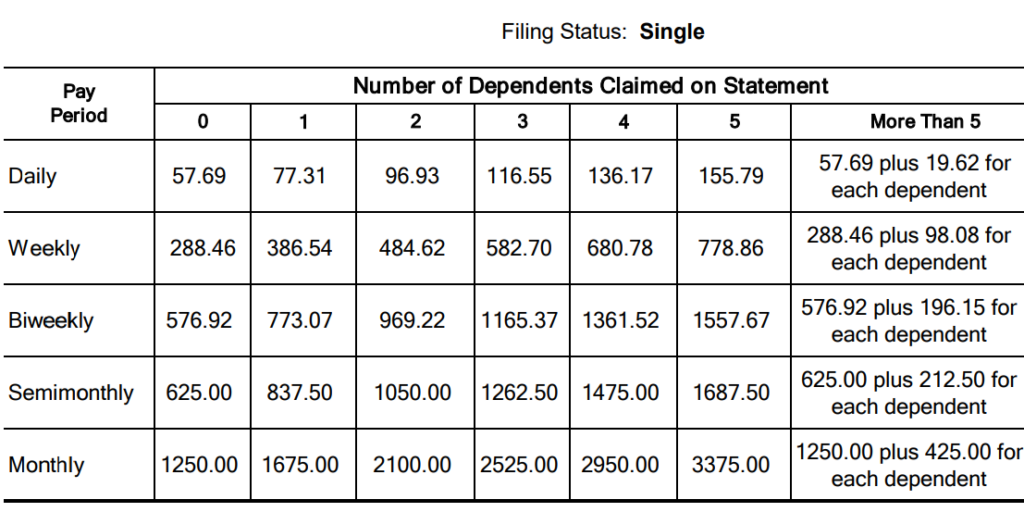

File Returns as Single 2025

File Returns as Married Filing Joint 2025

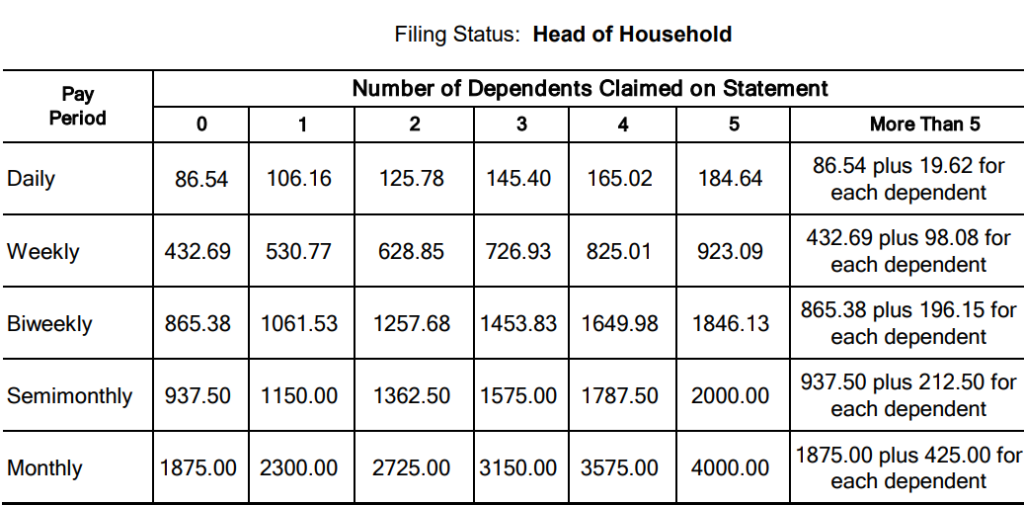

File Returns as Head of Household 2025

Frequently Asked Question:

How much can the IRS garnish from each of my paycheck?

The IRS usually takes between 25% to 50% of your disposable income (this is the amount left after deducting social security and taxes). For specific numbers based on your income, please review the screenshots above which provides you the 2025 wage garnishment table.

How long can I owe the IRS before they garnish my wages?

The IRS will give you a 30 day period to stop the wage garnishment, negotiate, or submit an appeal.