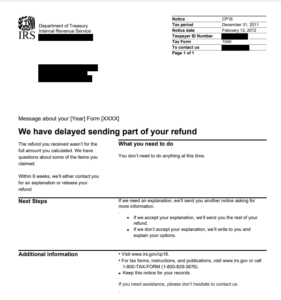

CP18

The image above is an example of the CP18 form you will receive via mail – it will include your name and physical mailing address. Essentially the IRS is claiming that one or more of the deductions made by you are incorrect – which leads to the IRS reviewing and making corrections to your return.

Item Not Allowed, Balance Due is to inform taxpayers that an item on their tax return was not allowed and they now have a balance due. This notice falls under the category of “return accuracy”. IRS Notice CP19 is used by the IRS to report unilateral changes made to your return. It often follows a Notice CP18. When the IRS denies you a refund they send Notice CP19. If the IRS partially denies a refund they send Notice CP20. The most common reason to send this notice is to deny you a Fuel Tax Credit. This credit is claimed on IRS Form 4136. The IRS prints publication 510 which has a chapter devoted to the Fuel Tax Credit. The IRS is usually concerned about scams involving the Fuel Tax Credit so they have been auditing these returns for the last few years.

REASONS WHY YOU RECEIVED NOTICE CP19 FROM THE IRS

There are some reasons why taxpayers receive this notice. They include:

- Taxpayers filed an original tax return and in the process of the IRS processing the return, they determined that a credit or deduction on the return would not be allowed.

- Taxpayers received a Notice CP18 notifying them that part of the expected refund was being withheld, pending further review.

- The IRS sent Notice CP19 to explain which item was not allowed. The notice also informs you that because of the changes made to the return, a balance is now due.

If you have received a CP19 Notice from the IRS, it is usually because the IRS believes you claimed one or more deductions and/or credits on your federal income tax return that you shouldn’t have. As a result, the IRS made adjustments to your return that increased the amount of tax you owe. A response form is usually included with or as part of a CP19 Notice, along with a request that the taxpayer should fill the form out, sign it, and return it to the IRS within 30 days of the date of the notice.

This could affect any Income Tax Audits & Appeals that you are involved in, as well as IRS Tax Litigation or Tax Collection actions.

The IRS thinks that you made some error whatsoever on your tax return and you may be wondering why the IRS thinks so, besides your tax return, the IRS also receives financial data about you from third parties such as your employers, clients, banks and more legal entities. As you know, there are also many rules about what you can claim as a deduction and what qualifies you for a tax credit. Based on the information available to them, the IRS has made the determination that you owe additional tax.

WHAT YOU SHOULD DO AFTER RECEIVING IRS NOTICE CP19

- Read the CP19 Notice carefully, especially all parts of the notice where the IRS identifies what deductions and/or credits it believes you claimed improperly and what changes it made to your return. Then review the relevant parts of your tax return for any signs of an obvious mistake on the return you filed.

- Even if, after reviewing your tax return, you agree with the adjustments the IRS made to your return and its revised amounts, it is still a very wise idea to discuss the matter with a tax law professional before you fill out, sign, and return the response Form enclosed with the CP19 Notice. Signing and returning a response form without first undergoing a careful analysis of the underlying issue and any related matters can be a serious trap for the unwary. Time is of essence in terms of your response to a CP19 Notice. Because interest will increase and additional penalties may apply if you do not provide the IRS with a written response to the CP19 Notice within 30 days, it is extremely important that you seek legal advice quickly after receiving the notice.

- If, after reviewing your tax return, you do not agree with the adjustments the IRS made to your return, it is also usually very prudent to consult a tax professional before you fill out, sign, and return the enclosed response Form indicating your disagreement. The IRS usually asks the taxpayer to whom it sends a CP19 Notice to provide documentation supporting the taxpayer’s position that a return was correct as filed. A response that is carefully prepared by a tax law professional that provides appropriate supporting documentation and nothing more can often mean the difference between quick resolution and a drawn out audit that leads to additional areas of inquiry.

When responding to the IRS Notice CP19, you will have to determine if you are entitled to the Fuel Tax Credit. Review Publication 510 for all the qualifications & limitations. You may determine that you are entitled to the deductions. In that case, you will need to get a letter from your employer or your companies’ employee manual to prove that your employer doesn’t pay the tax. You only get the credit if you had to pay for the fuel.

Next, you’ll have to get all your fuel receipts, mileage or trip logs, payments & reimbursements to prove your claim. This will take a lot of work since the IRS will want your evidence properly organized or they won’t review it. They will simply continue to deny the credit. Fortunately, there is a section in the Audit Defense Program devoted to the Fuel Tax Credit for specific guidance.

NOTICE DEADLINE – 30 days from the day the IRS sent notice CP19 to you. If you miss this deadline, additional penalties and interest will accrue. Interests will accrue on an unpaid tax balance beginning on the day after the tax is due. Also, you will be assessed a late payment penalty if the full amount of tax you owe is not paid on the day it is due. With respect to both interest and penalties, the due date is the last date on which you could file the tax return that is at issue, including extension requests.

Here’s How It works:

Free Consultation

One of our tax expert will get the details of your situation and discuss your options for FREE

Investigation

Initiate client protection Establish communication with IRS Review case summary options (2-4 weeks)

Resolution

Establish IRS compliance Achieve the best resolution (3-9 months)

Freedom

Congratulation, your case has been closed (Done)